Back ...

Read More20apr4:00 pm10:00 pmTacos and Margaritas Bar Crawl Savannah

Everyone’s favorite combo: Tacos and Margs are combined in this massive event! Check-in, start feasting at our Taco Station to get a good base and then start your margarita journey

Everyone’s favorite combo: Tacos and Margs are combined in this massive event! Check-in, start feasting at our Taco Station to get a good base and then start your margarita journey where each bar will have their own take on a margarita for you to enjoy!

(Saturday) 4:00 pm - 10:00 pm

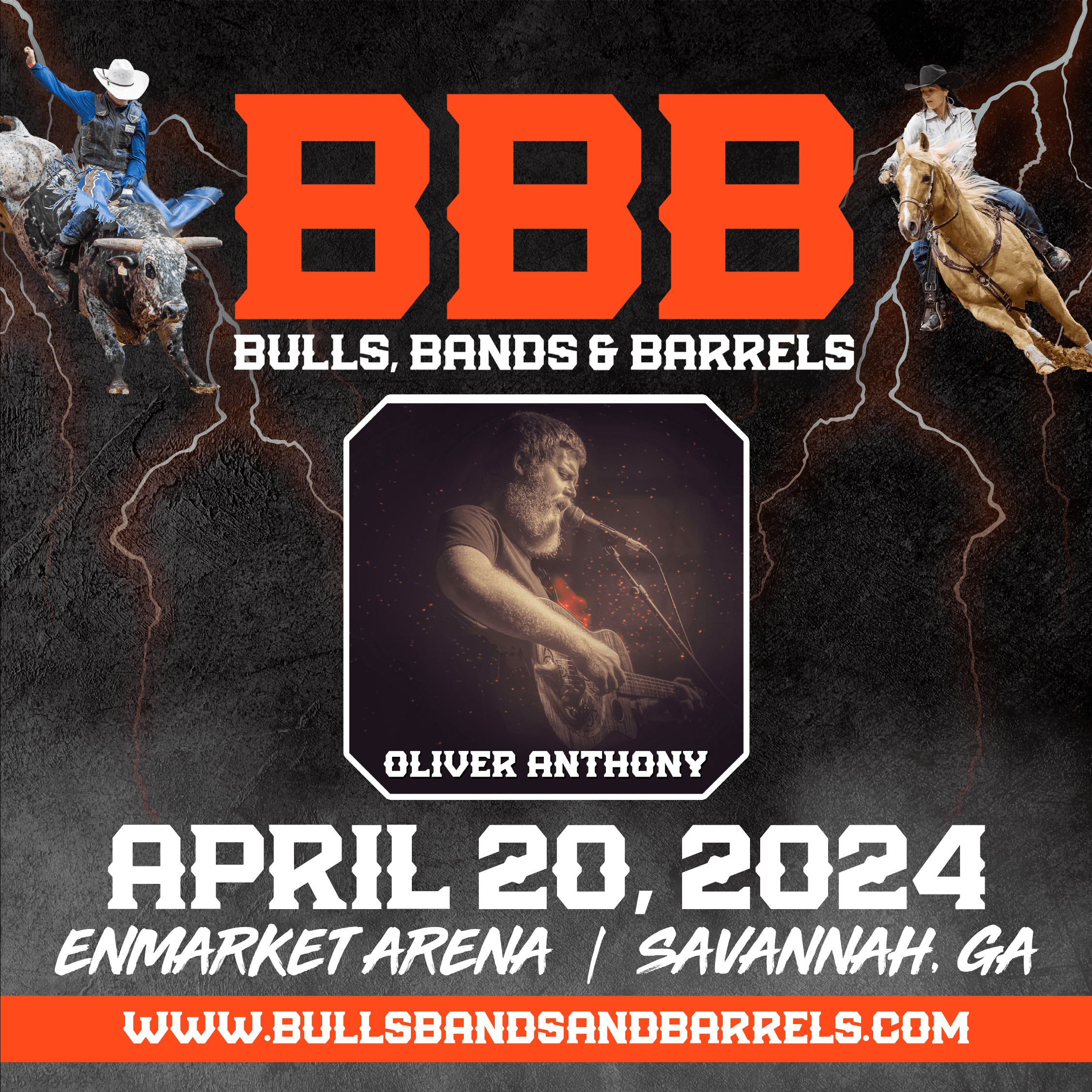

20apr6:00 pmBulls, Bands & BarrelsThis Ain't Your Grandpappy's Rodeo!

Bulls, Bands & Barrels is the premier western sports competition and live entertainment experience, bringing together rodeo and live music fans in professional arenas and rodeo facilities across the United

Bulls, Bands & Barrels is the premier western sports competition and live entertainment experience, bringing together rodeo and live music fans in professional arenas and rodeo facilities across the United States. BBB features competitive bull riding, barrel racing and bullfighting which are considered the most exciting rodeo events today. Join us for an exciting evening – which will have you on the edge of your seat and guaranteed to thrill!

(Saturday) 6:00 pm

Enmarket Arena

621 Stiles Avenue, Savannah, GA 31415

20apr7:00 pm10:00 pmThe DIRTT - The Ultimate Motley Crue Experience!

Welcome to Coach’s Corner Welcomes The Dirtt In Concert! Join us for a night of live music at Coach’s Corner on East Victory Drive in Thunderbolt, GA, USA. Get ready

Welcome to Coach’s Corner Welcomes The Dirtt In Concert! Join us for a night of live music at Coach’s Corner on East Victory Drive in Thunderbolt, GA, USA. Get ready to rock out with The Dirtt as they take the stage and bring the house down with their incredible performance. Don’t miss out on this epic event – grab your friends and come on down for a night you won’t forget!

THE DIRTT- A HIGH ENERGY FLORIDA BASED ROCK BAND PAYING TRIBUTE TO THE WORLD’S MOST NOTORIOUS ROCK BAND MÖTLEY CRÜE. THIS DRIVING HIGH OCTANE ACT PERFORMS A TWO-HOUR SHOW OF YOUR FAVORITE SONGS FROM THE ICONIC BAND THAT BUILT THE 80S AND 90S AND CONTINUES TO ROCK TODAY.

THE DIRTT FOCUSES ON IDENTICAL MUSIC COLLABORATIONS, HEAVY MUSICAL CHOPS, BIG DRUMS AND KILLER VOCALS TO SING WITH ALL NIGHT. THIS SHOW ROCKS AND IT IS AN ASSAULT TO YOUR SENSES.

(Saturday) 7:00 pm - 10:00 pm

Coach's Corner

3016 East Victory Drive Thunderbolt GA

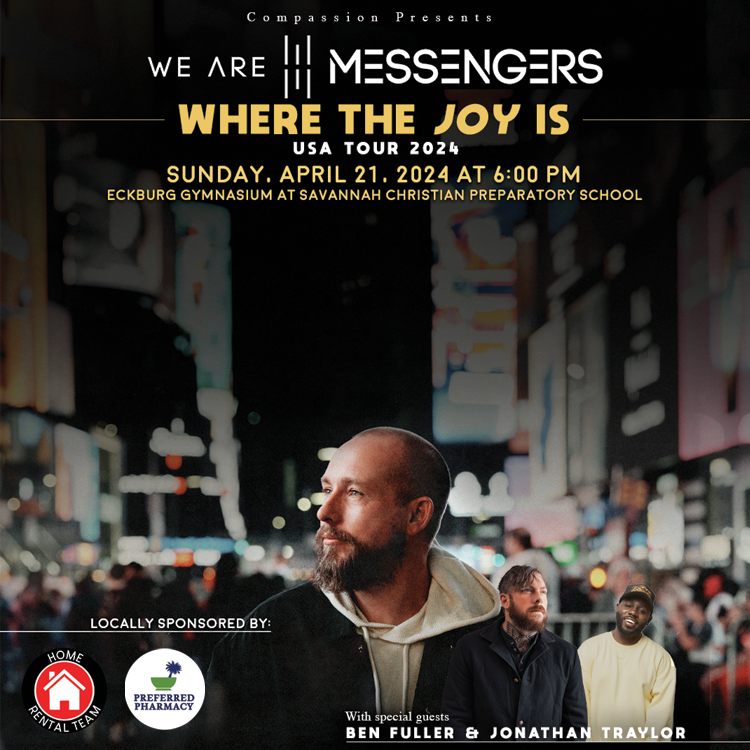

21apr6:00 pmWe Are Messengers - Where The Joy Is Tour

Join us on Sunday, April 21st at Savannah Christian Preparatory School’s Eckburg Arena! Ticket prices are as follows: $60.00 – VIP Early entry to the venue at 4:15pm Early access to merch

Join us on Sunday, April 21st at Savannah Christian Preparatory School’s Eckburg Arena! Ticket prices are as follows:

$60.00 – VIP

Early entry to the venue at 4:15pm

Early access to merch shopping from 4:15 – 4:30pm

30 minute pre-show Q&A with Darren of We Are Messengers from 4:30-5:00pm

Best seats in house

VIP exclusive tour laminate

$35.00 – Early Entry

Gain access to the best seats available – behind the VIP section (or any open & available seat of your choice)

Early Entry ticket holder doors will open 15 minutes before General Admission doors

Must be present at venue & in line before 5:00pm to gain access to this Early Entry experience

No seats will be reserved. This ticket only gains you access to have early entry into the venue

$25.00 – General Admission

General admission doors will open at 5:15pm

First come, first served seats for all General Admission ticket holders

(Sunday) 6:00 pm

(Tuesday) 8:00 pm

Johnny Mercer Theatre

301 W Oglethorpe Ave, Savannah, GA 31401

26apr8:00 pmSavannah Comedy Festival

(Friday) 8:00 pm

Johnny Mercer Theatre

301 W Oglethorpe Ave, Savannah, GA 31401

27apr11:00 am4:00 pmThunderbolt Blessing of the Fleet

Get ready for a maritime spectacle like no other! The 2024 Thunderbolt Blessing of the Fleet is back for year 3 after a triumphant two-decade hiatus, promising a tidal wave of

Get ready for a maritime spectacle like no other!

The 2024 Thunderbolt Blessing of the Fleet is back for year 3 after a triumphant two-decade hiatus, promising a tidal wave of excitement. Join us in honoring Thunderbolt’s rich shrimping and fishing heritage with a spectacular fleet blessing, accompanied by the harmonious beats of live music echoing along the enchanting Wilmington Riverfront. Indulge your taste buds with diverse culinary delights from food trucks and local Thunderbolt eateries, explore vibrant vendor stalls, and revel in free activities that make this event a true celebration of community spirit.

Don’t miss the boat—whether you’re a vendor, sponsor, or eager volunteer, set sail with us by reaching out to events@thunderboltga.org. This is the maritime event of the year, and you’re invited to be part of the wave!

(Saturday) 11:00 am - 4:00 pm

River Drive, Thunderbolt

28apr7:30 pmAn Evening with Kenny G

(Sunday) 7:30 pm

Johnny Mercer Theatre

301 W Oglethorpe Ave, Savannah, GA 31401

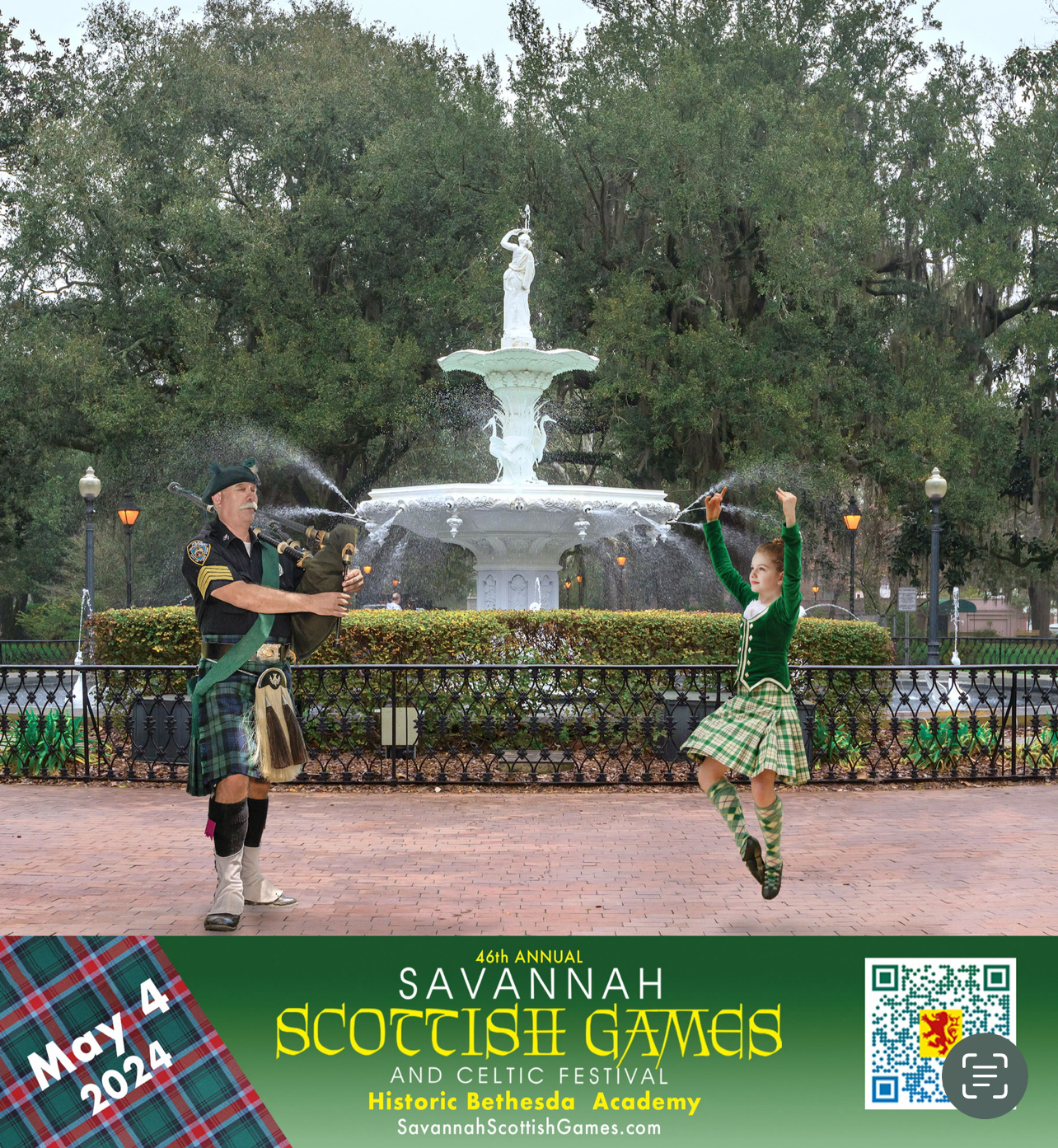

04may8:45 am5:00 pmSavannah Scottish Games46th Annual Savannah Scottish Games

The Savannah Scottish Games are taking place on the beautiful grounds of Historic Bethesda Academy on May 4, 2024! It is a grand celebration of Scottish heritage, with celtic music,

The Savannah Scottish Games are taking place on the beautiful grounds of Historic Bethesda Academy on May 4, 2024! It is a grand celebration of Scottish heritage, with celtic music, pipe bands, clans, highland dancing, heavy athletic events (athletes throwing telephone poles), children’s activities, sheep herding, falconry, genealogy, hockey booth, food, and fun for the entire family.

(Saturday) 8:45 am - 5:00 pm

Bethesda Academy

04may9:00 am2:00 pmSpring Plant Sale ~ A fundraiser for Savannah Botanical Gardens

Start your day here! Rain or shine, this annual Spring Plant Sale will be held on Saturday, May 4, 2024 from 9 am to 2 pm at the historic Reinhard

Start your day here! Rain or shine, this annual Spring Plant Sale will be held on Saturday, May 4, 2024 from 9 am to 2 pm at the historic Reinhard Farmhouse at 1388 Eisenhower Drive. Sponsored by the Savannah Area Council of Garden Clubs and the Savannah Botanical Gardens, the sale raises funds to benefit the Savannah Botanical Gardens.

There will be decorative pots for sale and lots of lovely plants and flowers to go in them – including Day Lilies & pass-along plants donated by local area garden club members. Master Gardeners will be on hand to answer gardening questions.

Free admission & free parking. For more info, call (912) 355-3883 or email sacgc1388@botanical.comcastbiz.net.

(Saturday) 9:00 am - 2:00 pm

Savannah Botanical Gardens

1388 Eisenhower Dr, Savannah, GA 31406

04may3:00 pm10:00 pmRelay for Life of the Coastal Empire

Relay For Life brings the fight against cancer to your community. Relay For Life is the ultimate team fundraiser for the American Cancer Society that brings communities together to fight

Relay For Life brings the fight against cancer to your community. Relay For Life is the ultimate team fundraiser for the American Cancer Society that brings communities together to fight cancer. It’s an opportunity for us to remember loved ones lost and honor survivors of all cancers. This year’s theme is Carnival for a Cure so get ready to have fun & support a cancer fighter!

(Saturday) 3:00 pm - 10:00 pm

The Olde Pink House and Park Place Outreach, Inc. are partnering to host Savannah’s Premier Kentucky Derby Party to support programming for homeless, runaway and at-risk youth in the Savannah

The Olde Pink House and Park Place Outreach, Inc. are partnering to host Savannah’s Premier Kentucky Derby Party to support programming for homeless, runaway and at-risk youth in the Savannah community. Attendees will have the opportunity to watch the 150th Kentucky Derby via livestream at Savannah’s must-attend Derby Party while enjoying unlimited Pink House cuisine and cocktails, including Woodford Reserve Mint Juleps and Casa Herradura Margaritas.

Olde Pink House Executive Chef Vincent Burns and his accomplished culinary team will prepare a wide range of Derby-themed culinary delights, including Braised Beef Short Ribs, Kentucky Hot Brown Sandwiches, Baby Back Ribs, Deviled Eggs, Chicken and Shrimp Tacos, Cucumber Tea Sandwiches and Banana Pudding.

The Olde Pink House will also host competitions for Best Bow Tie, Best Hat/Fascinator and Overall Best Dressed, awarding special prizes in each category. Live music will be provided by The Fractions, a popular local band performing original material as well as rock classics, pop and country.

Guests are invited to participate in a silent auction featuring a three-day, two-night trip to the award-winning Woodford Reserve distillery in Versailles, Kentucky as well as a private barrel selection. In addition, a special raffle will offer a range of items, including a signature Pink House spirits basket, Woodford Reserve golf bag and round of golf at Savannah Quarters Country Club.

Proceeds from Savannah’s Premier Kentucky Derby Party will benefit Park Place Outreach’s programming to support at-risk youth in the Savannah area. Services include emergency shelter, transitional living, crisis intervention, family preservation, and homelessness diversion services. Must be 21 to attend this event.

(Saturday) 4:00 pm - 7:00 pm

East Saint Julian Street @ the Olde Pink House

23 Abercorn Street, Savannah, GA 31401

04may7:00 pmPete Davidson LiveThe Prehab Tour

Get ready for a night of uncontrollable laughter with Pete Davidson as he takes the stage for a live stand-up comedy show like no other! 🎤 Known for his irreverent

Get ready for a night of uncontrollable laughter with Pete Davidson as he takes the stage for a live stand-up comedy show like no other! 🎤 Known for his irreverent humor, sharp wit, and unfiltered takes on life, Pete brings a fresh and edgy perspective to the world of comedy.

From hilarious anecdotes about his own experiences to fearless commentary on the absurdities of modern life, Pete Davidson’s stand-up is a rollercoaster of laughter that you won’t want to miss.

(Saturday) 7:00 pm

Johnny Mercer Theatre

301 W Oglethorpe Ave, Savannah, GA 31401

04may7:00 pmSavannah State University's 25th Anniversary Scholarship Gala

Savannah State University’s 25th Anniversary Scholarship Gala is a celebration of the success of our institution and our students. The gala provides a meaningful opportunity for the community to support

Savannah State University’s 25th Anniversary Scholarship Gala is a celebration of the success of our institution and our students. The gala provides a meaningful opportunity for the community to support students who need financial help in order to earn a college degree. Approximately 90 percent of our students receive financial aid. Proceeds from the gala support scholarships for deserving students.

The evening will include the presentation of the Awards of Excellence, acknowledging a select group of distinguished individuals — alumni and friends — for their contributions to the university and the greater community in leadership, philanthropy, scholarship and service, arts and entertainment, and entrepreneurship.

(Saturday) 7:00 pm

Marriott Savannah Riverfront

100 General McIntosh Blvd

11may(may 11)10:00 am12(may 12)5:00 pmSavannah Comic Con

Comics, Guest, Vendors & More! Join us for our 10th year anniversary as we continue to build the only locally owned comic convention Savannah Comic Convention into the

Join us for our 10th year anniversary as we continue to build the only locally owned comic convention Savannah Comic Convention into the premiere Pop Culture event of Southeast Georgia!

11 (Saturday) 10:00 am - 12 (Sunday) 5:00 pm

16may1:00 pm5:00 pmTEDxSavannah 2024: ConvergenceGet inspired at TEDxSavannah 2024!

TEDxSavannah, an independently organized celebration of ideas worth spreading based on the international TED talk phenomenon, will return in 2024 with an exciting half-day showcase featuring a diverse group of

TEDxSavannah, an independently organized celebration of ideas worth spreading based on the international TED talk phenomenon, will return in 2024 with an exciting half-day showcase featuring a diverse group of local speakers focusing on the theme of Convergence. Tickets are currently available at tedxsavannah.com.

The highly anticipated 2024 TEDxSavannah event will take place on Thursday, May 16, 2024 from 1 to 5 p.m. at the Fine Arts Auditorium at Georgia Southern University’s Armstrong Campus, located at 11935 Abercorn St. in Savannah, Ga. Doors will open at noon.

The 2024 TEDxSavannah event will feature thought-provoking talks by area residents and thrilling live performances. Each TEDxSavannah speaker is limited to a maximum of 12 minutes to present an interesting talk influenced by the theme and of interest to the Savannah community. Live talks will be filmed and posted on the TEDx Talks YouTube channel, which has more than 39 million subscribers, following the event.

TEDxSavannah tickets are currently on sale, which include seating, onsite parking, snacks, coffee and admission to the speaker meet-and-greet immediately following the main TEDxSavannah event. Early bird, VIP and nonprofit/student/educator/first responder/active-duty military tickets are available for purchase online at tedxsavannah.com. Groups of more than six attendees can receive a 10% discount on the price of their tickets by contacting Allison Hersh at allison@capricorncomm.com.

Sponsorship opportunities are currently available for TEDxSavannah 2024. Local businesses interested in sponsoring the 2024 TEDxSavannah event are encouraged to contact the organizing committee at tedxsav@gmail.com.

(Thursday) 1:00 pm - 5:00 pm

21may5:30 pm7:00 pmSips at the Station

Get excited and join us for Savannah’s most diverse networking event series, Sips at the Station, as we spotlight a rotation of nonprofits

Get excited and join us for Savannah’s most diverse networking event series, Sips at the Station, as we spotlight a rotation of nonprofits each month. Hosted by Ardsley Station, Savannah Master Calendar, and Simply Savannah Marketing, admission is a $10 donation and includes a complimentary beverage from Ardsley Station’s special bar menu and an assortment of unique, off-menu, hors d’oeuvres, all while enjoying live music. Raffle tickets are also available for purchase, and 100% of proceeds from admission and raffle sales go to the month’s chosen nonprofit.

___

We are excited to announce April 16th’s event will benefit Gilliard and Company, a 501(c)3 charity that provides support to current foster children/ young adults through advocacy, compassion and empowerment.

Gilliard & Company works to transform the lives of young adults transitioning out of foster care through the implementation of services and programs these young adults desperately need so they are able to thrive; offering trauma intervention and support, stability and safety through transitional housing, and mentors to supply the essential resources and guidance to help navigate the complexities of adulthood.

January – Heads-Up Guidance Services

February – Coastal Pet Rescue

March – Make-A-Wish

April – Gilliard & Company

May – TBD

June – TBD

July – TBD

August – TBD

September – TBD

October – TBD

November – TBD

Thank you also to our longtime sponsors and supporters – Creature Comforts Brewing, Tito’s Vodka, and Woodinville Whiskey, as well as all of those who have continued to make this event such a success!

(Tuesday) 5:30 pm - 7:00 pm

Ardsley Station

102 E Victory Dr, Savannah, GA

26may7:30 pmWWE: NXT Battleground and Monday Night RAW

WWE RETURNS TO SAVANNAH’S ENMARKET ARENA FOR TWO BACK-TO-BACK NIGHTS OF ACTION SEE THE 1st WWE PREMIUM LIVE EVENT EVER TO TAKE PLACE IN SAVANNAH WITH NXT BATTLEGROUND,

WWE RETURNS TO SAVANNAH’S ENMARKET ARENA FOR TWO BACK-TO-BACK NIGHTS OF ACTION

SEE THE 1st WWE PREMIUM LIVE EVENT EVER TO TAKE PLACE IN SAVANNAH WITH NXT BATTLEGROUND, FOLLOWED BY MONDAY NIGHT RAW

LIVE AND BROADCAST TO THE WORLD FROM ENMARKET ARENA

SEE ALL OF YOUR FAVORITE SUPERSTARS FROM NXT AND MONDAY NIGHT RAW

COMBO TICKETS FOR BOTH EVENTS WILL BE AVAILABLE STARTING FRIDAY FEBRUARY 2!

(Sunday) 7:30 pm

Enmarket Arena

621 Stiles Avenue, Savannah, GA 31415

april, 2024

Event Type

All

Arts & Entertainment

Business / Nonprofit

SMC Top Picks

Virtual / Zoom

Categories

All

advocacy-causes

animals-pets

anniversary-birthday

art

association-club

award-ceremony

beauty-fashion

books-literature

business

careers-employment

cars-motorcycles

class-seminar-workshop

Comedy

community

conference-expo-trade-show

culture

Dance

discussion-lecture

education

environment

family-friendly

farmers-market

festival

film

food-beverage

fundraiser

gala-ball

government-politics

grand-opening-ribbon-cutting

health-wellness

history

holiday

lgbtq

music

networking

nonprofit-charity

Party

performing-arts-theater

races-runs

Religion

science

shopping

social

sports-athletics

support-group

technology

tour

travel-tourism

veterans

Event Location

All

110 Burke Ave, Savannah, GA

1116 East Montgomery Crossroads Savannah GA

115 Charlotte Road, Whitemarsh Island, GA

11th Street

1210 Myers St, Savannah, GA

144 Darling St, Savannah GA

144 Darling Street, Garden City, GA

14th Street on Tybee Beach

1540 Room

15th St, Tybee Island

1651 Victory Drive

17 Hundred 90 Inn and Restaurant

17 South Haunted Forest

17 South Rod and Gun Club

17th Street Inn

1801 E 32nd St, Savannah

1810 Mills B Lane Boulevard

1955 Westlake Ave, Savannah, GA

19th Street beach access on Tybee Island

2 Souls As 1

200 Jackson Woods Blvd, Savannah, GA

201 Seafood Restaurant

201 Tapas Lounge

2011 Waters Ave

208 Wine Bar

209 Whitehall

22 Rose Ave

22 Square Restaurant & Lounge

2302 EAST GWINNETT STREET, SAVANNAH, GA

24e

24e Warehouse Sale

2nd Ave Beach Access

3 Points Food Court

300 Drayton St

302 East 48th St.

305 W Collins St, Pooler, GA

308 E. Hall St. Savannah, GA

311 Eisenhower Drive, Savannah, GA

39 Rue de Jean Savannah

3rd Annual Greek & Civic Cleanup Day

40 Volume Salon

402 E Broughton St

426 Abercorn Street

45 Bistro

5 Spot Restaurant

510 West Gwinnett St

5111 Abercorn Street

513 E. Oglethorpe Savannah

5212 Silk Hope Road, Garden City, GA

5414 Skidaway Rd, Savannah, Georgia

5698 Ogeechee Road

6 East State

602 Abercorn St

622 E 37th St

67 W Bluff Dr

6911 Skidaway

700 Kitchen Cooking School at The Mansion on Forsyth Park

700 Wilmington

714 Martin Luther King Junior Blvd, Savannah, GA

7215 Sallie Mood Drive

7224 GA-21, Port Wentworth, GA 31407

75 Green Island Rd, Savannah, GA

787 by Chazitos

912 Brew Coffee and Tea House

920 E Victory Dr, Savannah, GA 31405

920 East Victory Dr, Savannah, GA

Abode Studios

ACE Women's Business Center

Ad Specialty Services

Adler Hall

Advanced Academics

Advanced Academics Academy

Advanced Regenerative Therapy

African American Health Information and Resource Center

Alair Homes Savannah

ALDI Savannah

Alee Shriners Temple

Alee Temple

Alexander Hall Gallery

Alfred Ely Beach High School

Alida Hotel

All Things Chocolate And More

Allen E. Paulson Softball Complex

Alley Cat Lounge

Allier Port Wentworth

Aloft Hotel - Downtown

Aloft Hotel - Downtown Savannah

Aloft Savannah Downtown Historic District

AMBUC Ballpark

Ambuc Park

America's Second Harvest of Coastal Georgia

America's Second Harvest Volunteer Center

American Legion Ballroom

American Legion Post 135

American Legion Post 154

American Legion Post 184

American Prohibition Museum

American Traditions Vocal Competition

AMF Bowling Lanes

AMF Savannah Lanes

AMPT - Savannah

Ancient & Accepted Scottish Rite of Savannah

Andaz Hotel

Andaz Savannah

Andaz Savannah 22 Square Restaurant

Anderson Cohen Weightlifting Center

Andrew Low House

Andy Kramer Auctions

Angel Learning Center

Ann Street Lofts

Antojo Latino

Aqua Star

Aqua Star Restaurant

AR Workshop Savannah

Archipelago Jewelry

Arco Cocktail Lounge & Coastal Fare

Arco Cocktail Lounge & Coastal Fare42 E. Bay Street, Savannah

Ardsley Station

Armstrong Campus, Georgia Southern University

Armstrong Center

Armstrong State University

Armstrong Student Rec Center

Arnold Hall

Arnold Hall Theatre

Artillery Bar

Arts Southeast, Sulfur Studios

Artstryngs Gallery

Artstryngs Gallery & Studio

Asbury Memorial Church

Asbury Memorial Theatre

Asbury Memorial United Methodist Church

Asbury United Methodist Church

Ascend Wellness

Asher and Rye

Asher Rye

Ashford Tea Company

Athletics & Mindfulness Personal Training (AMPT)

Atlanta Meditation Center

Atlantic

Augusta Convention Center

Avani Atrium Bangkok Hotel

Avondale Neighborhood

B & D Burgers - Abercorn St

B & D Burgers - Broughton St

B & D Burgers - Congress St

B & D Burgers - Pooler

B Matthew's Eatery

B. Mathews

B&D Burgers, Congress St

Bach Ascending

Back in the Day Bakery

Bacon Bark Golf Course

Bacon Park Golf Course

Bacon Park Tennis Center

Bad Obsession Records

Bahá'í Unity Center of Savannah

Bahama Joe's

Bahama Joe's School Uniform Store

Baker McCullough Funeral Home

Balanced You Natural Emporium

Ballastone Inn

Bangkok, Thailand

Baobab Lounge

Bar · Food

bar by fleeting

Bar Julian

Bar•Food Sports

Barnes & Noble - Oglethorpe Mall

Barnes and Nobl

Barnes and Noble

Barnes Restaurant

Barnes Restaurant Waters Avenue

Barrelhouse South

Bass Pro Shop

Bass Pro Shops

Bay Street Blues

BAY Street Theatre

Beach Institute African-American Cultural Center

Beaufort County Library, Beaufort Branch

Beaufort Dermatology

Beaufort, South Carolina

Belgrade,Serbia

Belhaven

Belhaven Acres

Belk, Savannah

Bellwether House

Ben Tucker Theater

Benedictine Military School

Bentley's Pet Stuff

Bentley's Pet Stuff - Habersham

Bentley's Pet Stuff, Whitemarsh

Berkeley Hall Club

Berwick Plantation

Best Western I-95

Best Western Premier Hotel

Bethesda Academy

Bethlehem Missionary Baptist Church

Better than Sex

Big Bon Bodega

Bike Walk Savannah

Billy's Place Savannah

Bitty & Beau's Coffee

Black Rabbit

Black Rifle Coffee Shop

Blade & Bull Axe Throwing

Blandford Elementary School

Blood Moon Acres

Bloom and Grow Open Market

Bloomingdale Community Center

Bloomingdale History Museum And Society

Bloomingdale Rodeo

Blowin' Smoke

Blue Force Gear

Bluemercury, Savannah

Bluffton Aesthetics

Board & Brush Creative Studio

Body Polish

BodyBrite

Bogey's

Bogeys Sports Bar & Mini Golf

Boles Park

Bonaventure Cemetery

Bonaventure Cemetery Jewish Chapel

Boomers Restaurant

Boomys

Bostwick Pavilion at Moss Creek

Bowlero Savannah

Bowles Ford Swimming Pool

Bowls & Bubbles

BowTie Barbecue

Brewed SAV

Bright Life Chiropractic

Brighter Day Natural Foods

Britannia British Pub

Broad Street Interiors

Broadcast Event

Brockington Hall

Brooklands Savannah

Broughton Common

Broughton Street

Brunswick Christian Academy

Bryan County Bark Park

Bryan County Senior Citizens Center

Bryson Hall

Bubba's Bistro

Buckwalter Place Park

Bull St & 32nd St

Bull St & Broughton St

Bull Street Baptist Church

Bull Street Estate Sales

Bull Street Estate Sales and Consignments

Bull Street Labs

Bull Street Library

Bull Street Light Room

Bull Street Taco

Burnt Church Distillery

Business Innovation Group

Butler Elementary School

Butler Memorial Presbyterian Church

Butterducks Winery

Byrd Cookie Company

C.O.B.R.A. Self-Defense

Cabana Club at the Alida Hotel

Café Taureau

Calvary Baptist Temple

Calvary Day School

Cambria Hotel Savannah Downtown Historic District

Cambria Showroom

Camp Villa Marie

Can Be Employed

Canaan Community Church

Canaan Community UMC

Candler County Historical Society

Candler County Historical Society and The History Museum

Candler County Historical Society Open Air Market

Candler General Hospital Marsh Auditorium

Candler Hospital-Marsh Auditorium

Candler Professional Building Room 508

Capitol Hill

Capt. Mike's Dolphin Adventures - Tybee Island

Captain Butler's Retreat

Captain Derek's Dolphin Adventures

Career Center - Georgia Department of Labor

Carey Hilliard Banquet Room

Carey Hilliard's, Abercorn St

Carey Hilliard's, Hwy 80 Garden City

Carey Hilliard's, Skidaway Rd

Carey Hilliards

Carlisle of York

Carnegie Library

Carol's Pampered Pets

Carolina Hemp Company

Carrabbas

Carrie E. Gould Elementary School

Caruso, Kurelic, MacKelfresh and Associates, LLC

Carver Village Center

Carver Village Community Center

Casimir's Lounge at The Mansion on Forsyth Park

Casimir's Lounge

Castaways Sandfly

Cathedral of St. John the Baptist

Catholic Diocese of Savannah

CB Entertainment

CDJRF South Savannah

Cedar House Gallery

Center Parc Credit Union

Center Parc Credit Union at Walmart in Pooler

Center Parc Credit Union at Walmart on Ogeechee

Cerberus Legion Games

Cesaroni Park

Cha Bella

Charles C. Brooks Park

Charles Ellis Montessori garden

Charles H. Morris Center

Charles Morris Center

Charles Morris Center at Trustees' Garden

Charleston Hemp Collective

Chart House Savannah

Chatham Area Transit (CAT) Central

Chatham Club at the DeSoto

Chatham County Animal Services

Chatham County Aquatic Center

Chatham County Commission

Chatham County Courthouse

Chatham County Democratic Committee

Chatham County GOP BBQ Open House

Chatham County Health Department

Chatham County Health Department - Midtown

Chatham County Recycles

Chatham County Sheriff’s Complex

Chatham County Sheriffs Office

Chatham Parkway Lexus

Chatham Parkway Subaru

Chatham Parkway Toyota

Chatham Savannah Authority for the Homeless (CSAH)

Chazito's Latin Cuisine

Chazito's Latin Cuisine, Pooler

Cheers to You

Chef Darins Kitchen Table

Chevis Oaks Baptist Church

Chick-fil-A Lowcountry Locations

Chick-fil-A Pooler

Chick-fil-A Vidalia

Children's Hospital Of Savannah

Children's Museum of Pooler

Chipotle

Chippewa Square

Chocolate Martini Bar

Christ Church

Christ Church Anglican

Christ Church Episcopal

Chrysler Dodge Jeep Ram Fiat North Savannah

Chrysler Dodge Jeep RAM Fiat North Savannah (Jeep Homeland)

Chrysler Dodge Jeep RAM Fiat South Savannah

Chrysler Dodge Jeep Ram North Savannah

Chrysler Dodge Jeep Ram South Savannah

Churchill's Pub

Circa Lighting

Circle of Recovery Peer Center

Cirque Divina in the Savannah Mall

Citizen's Bank & Trust, Richmond Hill

City Church

City Market

Civic Center Arena

Clarence E Morgan Complex

Clark Creative Design

Clary's Cafe

Clayer & Co.

Clearing House Savannah

Clifton Baptist Church

Cloverdale Community Center

Cloverdale Neighborhood Center

Club 51 Degrees

Club at Savannah Harbor

Club at Savannah Quarters

Club Bardo

Club House

Club One

Clyde Venue

Coach's Corner

Coaches Corner

Coastal Care Partners

Coastal Care Partners Hodgson Memorial Drive location

Coastal Cathedral

Coastal Discovery Museum

Coastal Ear, Nose & Throat, Savannah Office

Coastal Empire Beer Co

Coastal Empire Beer Company

Coastal Empire Habitat for Humanity

Coastal GA Center

Coastal Georgia Botanical Gardens

Coastal Georgia Center

Coastal Health District

Coastal Heritage Society Museums

Coastal Home Care

Coastal Imaging and The Center for Women's Health

Coastal Kitchen Catering

Coastal Performing Arts Academy

Coastal Pet Rescue

Coastal State Prison

Coastal State Prison Warehouse

Coastal Wellness of Savannah

Cobb Galleria Centre

Cobb Galleria Centre - Hall A

Cobia Clark Nursery

Cobia Clarke Nursery

Coffee Bluff Marine Rescue Squadron

Coffee Deli

Cohen's Retreat

Coligny Plaza

Collegiate Church of St Paul the Apostle

Colleton River Club

Collins Quarter

Collins Quarter at Forsyth

Collins Quarter Forsyth

Collins Quater Forsyth

Colonial Park Cemetery

Columbia Square

Combat Boots 2 The Boardroom

Come As You Are Deliverance International Ministries, Inc.

Commission Chambers of the Old Courthouse

Common Restaurant

Common Thread

Community Bible Church of Savannah

Compassion Christian

Computer Learning and Innovation Center (CLIC)

Congregation Agudath Achim

Congregation Mickve Isreael

Congregation Mikve Isreael

Congress Street Social Club

Congress Street Up

Connect Savannah

Connexion Church

Connor's Temple Baptist Church

Consumed Church

Contractors Depot

Cooper Center

CORA Physical Therapy - Islands

CORA Physical Therapy, Pooler

CORA Physical Therapy, W Oglethorpe Ave

Cork House

CorkHouse

CorkHouse Gallery

Corleones Trattoria

Corporate Environments

Cosmic Corner

Cottage in Juliette Gordon Low Park

Cottonwood Suites

Cottonwood Suites Savannah Hotel & Conference Center

Courtland & Co.

Courtyard by Chuck Chewning

Courtyard by Marriot, Savannah Midtown

Courtyard by Marriott, Savannah Airport

Cove to Coast

Crafted Cocktail Co.

Cranmer Hall

Creative Approach

CreekFire Motor Ranch

CreekFire Resort

CrossFit Reborn

Crosswinds Golf Club

Crosswinds Golf Course

Crumbl Cookies

Crumbl Cookies - Pooler

Crumbl Cookies - Sandfly

Crunch Fitness

Crystal Beer Parlor

Crystal Gateway Marriott

Cumming Public Lobrary

Cuoco Pazzo Cucina Italiana

Cyclebar Midtown Savannah

D'Corner Latin Restaurant

Daffin Heights Garden

Daffin Park

Dance Savannah

Dancing Dogs Yoga Savannah

Das Box

Daufuskie Island

Davenport House Museum

De Soto Ave

Deals and Deals Day

Debellation Brewing Company

Deck Beachbar & Kitchen

Dedicated Senior Medical Center

Deeah's Events R Us

Deer Creek Course at The Landings

Delegal Marina

Demere Center

DeSoto Savannah

Desposito's Seafood Restaurant

DeVaul Henderson Recreation Park

Diocese of Savannah Catholic Pastoral Center

District 6 City of Savannah

District Gelato

District Live

District Live at Plant Riverside

District Live at Plant Riverside District

Dixon Park

DOGley Station Pet Resort

Donatos

Donatos Pizza

Donna PFENDLER-merkle

Dorchester Shooting Preserve

Double Tree Inn by Hilton

Doubletree by Hilton

DoubleTree by Hilton Columbus

DoubleTree by Hilton Hotel Savannah Historic District

Doug, Mike, and Dan

Dr. Priscilla Thomas Annex

Drawing Room Gallery at the Lodge

DreamHouse Studios

Dress Up Savannah

Driftaway Cafe

Driftwood Chiropractic

Dub's, A Public House

Dunkin'

Dunkin' of Vidalia, GA

Dunkin’ Donuts

E Shaver Booksellers

E-Z-GO of Hilton Head

E-Z-GO of Pooler

E. Shaver Starland Bookshop

E. Shaver, Starland

E. Shavers book sellers

Early Learning Academy

Early Learning Center at Henderson E. Formey

East End Provisions

East Georgia Center for Oral & Facial Surgery

East Saint Julian Street @ the Olde Pink House

Eastern Wharf

Eastern Wharf Dock, Savannah

Eastern Wharf Park

Eastern Wharf Savannah GA

Ebenezer Elementary School

Ebenezer Retreat Center in Rincon

Eclipse of Savannah

Edgar's Proof and Provision

Edgar's Proof & Provision

Edgar's Proof & Provision at 15 East Liberty Street

Edgelawn Circle Park

Edgemere Sackville Park

Edward Jones Investments - Momodou Senghore, CFP®, AAMS™

Effingham County Fairgrounds

Effingham YMCA

eFitClub of Bluffton

Eichholz Law Firm

EIGHT AUTOMOTIVE INC.

El Coyote

El Coyote Oyster Bar

El Rocko Lounge

Elan Savannah

Elate Apparel

Electric Moon Skytop Lounge (Plant Riverside District)

Electric Moon Skytop Lounge and The Moon Deck, Plant Riverside District - Power Plant Building rooftop

Eli Whitney Complex

Elite Ink Studio

Elks Lodge

Ellen Claire Soapery

Ellis Square

Embassy Suites by Hilton Savannah

Embassy Suites Savannah Historic District

Embry-Riddle Aeronautical University Savannah Area Campus

Emily McCarthy Shoppe

EmmaJames

Emmanuel Tabernacle Apostolic Faith Church Inc

Emmaus House

Emmet Park

EmployAbility

EmployAbility (formerly CCDS) **back building**

Emporium Kitchen & Wine Market

Empowerment Center

Encompass Health Rehabilitation Hospital of Savannah

Enmarket

Enmarket Arena

Entrance to Wymberley on Isle of Hope

Estate on the River

Everard Auctions

Everard Auctions and Appraisals

Evolve Furniture Studio

Exclusive Engravings

Exclusives

Expansive Johnson Square

Expansive Workspace

ExperCARE Health - Richmond Hill

ExperCARE Health - Statesboro

ExperCARE Pooler

ExperCARE Richmond Hill

Express Employment Professionals

F45 Starland

Factor's Walk

Fairfield Inn and Suites by Marriott Savannah Downtown/Historic District

Faith Deliverance Church

Family Promise of Savannah

Fat Radish

FBC Richmond Hill

Feiler Park Resource Center

Fellwood Park

Fête

Fia Rua Irish Pub

Finches Sandwiches and Sundries

Fine Arts Auditorium - Georgia Southern University

Fine Arts Auditorium - Georgia Southern University, Armstrong Campus

Fine Arts Auditorium Armstrong Campus, Georgia Southern University

Firehouse Subs

First African Baptist Church

First Baptist Church

First Baptist Church of Richmond HIll

First Baptist Church of Vidalia

First Bryan Baptist Church

First City Pride Center

First Mount Sinai Missionary Baptist Church

First Presbyterian Church

First Presbyterian Church - Washington Avenue

First Presbyterian Church of Savannah

First Tabernacle Missionary Baptist Church

Fishtails

Fit Gym Sandfly

FIT Sandfly

Fitzroy

Flajaes II

Flannery O'Connor Childhood Home

Fleet Feet Savannah

Flip Flop Shop

Flirt with Dessert

Flow Space Fitness Studio

Floyd "Pressboy" Adams Park

Floyd Adams Jr. Complex

Floyd Morris Field - Daffin Park

Flying Fish Bar & Grill

Ford Plantation

Ford Pool

Forest & Fin

Forest City Gun Club

Forest Park Pavilion

ForSight Unique Eye Care & Eye Wear

Forsyth Farmer's Market

Forsyth Park

Forsyth Park Bandshell

Fort McAllister State Historic Park

Fort Morris Historic Site

Fort Pulaski National Monument

Foundery Coffee Pub

Foxy Loxy Café

Fran Lindgren

Frank Callen Boys & Girls Clubs

Frank G Murray Community Center

Frank G Murray Community Center of Wilmington Island

Frank Murray Community Center

Franklin Creek Tennis Center

Free Verbal De-Escalation Training Webinar Series

Freedom Fellowship

Freedom Field

Freedom Park

Friendly Marketplace

Friendship Coffee Company

Front Porch Improv

Ft. Lauderdale Convention Centre Hall B 1950 Eisenhower Blvd Fort Lauderdale, FL 33316

Fuel Nutrition of Pooler

Full Bloom Salon & Dry Bar

Fun Zone

Functional Bodies

Future Site of Polaris community, organized by BuddyWatch, Inc.

FYZICAL Savannah

G-Force Manufacturing

Gallery 209

Gallery Espresso

Garden City City Hall

Garden City Empowerment Center

Garden City Gym

Garden City Library

Garden City Recreation Center

Garden City Recreation Center Parking Lot

Garden City Shopping Plaza

Garden City Town Center

Garden City United Methodist Church

Garibaldi Savannah

Gateway Church, Pooler Campus

Georgetown Family Dental

Georgetown Orthodontics

Georgia Freight Depot

Georgia Historical Society

Georgia Infirmary

Georgia Institute of Technology Savannah

Georgia Mentor

Georgia Queen River Cruises

Georgia Regional Hospital Savannah

Georgia Skin and Cancer Clinic

Georgia Southern Statesboro Campus, Performing Arts Center

Georgia Southern University

Georgia Southern University - Liberty Campus

Georgia Southern University - Statesboro

Georgia Southern University Armstrong Campus

Georgia Southern University Armstrong Campus Savannah

Georgia Southern University Armstrong Campus, Fine Arts Auditorium

Georgia Southern University Armstrong Campus, Health Professions Academic Center

Georgia Southern University Business Innovation Group

Georgia Southern University Statesboro Campus, Nessmith-Lane Center

Georgia Southern University/Armstrong Campus Student Union Building

Georgia State Railroad Museum

Georgia Tech Professional Education-Savannah

Georgia Tech, Savannah

Georgia Visitor Center

Georgia World Congress Center

Gerald's Pig and Shrimp

GFORCE MANUFACTURING -GOODWILL SOUTHEAST GEORGIA

Ghost Coast Distillery

Ghosts and Gravestones Savannah

Gillian Trask Showroom

Gingerbread House

GIRL Center

Glendale Civic Center

Glo's Coffee Corner

Goal Mentality LLC

Godley Station Dental

Good Times Jazz Bar & Restaurant

Goodwill

Goodwill Industries of the Coastal Empire- Opportunity Center

Goodwill Jesup

Goodwill Job Connection Center

Goodwill Opportunity Center

Goodwill Southeast Georgia

Goodwill Southeast Georgia - Berwick Store

Goodwill St. Simons Island Donation Center

Goose Feathers Cafe

Gordonston Art Fair

Gordonston Book Sale

Goshen Business Park Banquet Room

Goshen Park Commercial Center

Grace House

Grainger Honda

Grand Bohemian Gallery

Grand Lake Club

Grand Lake Club at Southbridge

Grand Mercure Bangkok Atrium

Grand Oaks Executive Plaza

Grand Prize of America Ave

Grand View Hotel Tybee

Graveface Lodge of Sorrows

Gray’s Reef Ocean Discovery Center

Grayson Stadium

Great Oaks Bank

Great Oaks Bank - Richmond Hill

Great Savannah Community Cleanup

Greater Gaines Chapel A.M.E.

Greater Mt. Bethel Holiness Church

Greater Pooler Area Chamber of Commerce

Greater Pooler Chamber of Commerce

Green Fire Pizza

Green Fire Pizza & Sports Bar

Green Truck Pub

Green-Meldrim House

Greenbriar Children's Center

Grove Point Plantation

GSHG GIRL Center

Guerry Lumber

Guerry Lumber Company

Gullah Art Gallery and Museum

Gunn Meyerhoff Shay

Gutstein Gallery

Guy Minick Park

Guy Minnick Park

Guyton Walking Trail

Habersham Village

Habersham Woods area near the YMCA

Habersham Woods neighborhood

Habersham YMCA

Habersham YMCA - Mason Trail

Habitat for Humanity

Habitat Savannah Groundbreaking Ceremony

HallofSneakz

HallofSneakz Store

HALO Models and Talent Agency

Hampton Inn & Suites Midtown

Hampton Inn & Suites Savannah Historic District

Hardeeville Recreation Center

Harkleroad Diamonds and Fine Jewelry

Harmony at Savannah

Harper Fowlkes House

Harper's Desserts

Harry's Bluff

Heavenly Spa by Westin Savannah

Hellenic Center

Hellenic Community Center

Henderson Golf Club

Henny Penny Art Space & Cafe

Henry C Chambers Waterfront Park

Herb River, 7th Dock from the Wilmington River

Heritage Oaks Golf Course

Higher Ground Baptist Church

Highlands Park

Hilton Garden Inn

Hilton Garden Inn Savannah Airport

Hilton Head BMW

Hilton Head Branch Library

Hilton Head Island Senior Center

Hilton Head Marriott Resort and Spa

Himalayan Curry Kitchen

Historic Bryan Neck Presbyterian Church and Manse

Historic Carver Village Community Center

Historic Downtown Port Wentworth

Historic Downtown Savannah

Historic Home

Historic Kennedy Pharmacy

Historic Madison Square

Historic Reynolds Square

Historic Savannah Foundation (HSF)

Historic Savannah Theatre

HITCH

Hogans' Marina

Holiday Inn & Suites, Savannah Airport

Holiday Inn Express

Holiday Inn Express Savannah-Historic District, an IHG Hotel

Holiday Inn Savannah Historic District

Holly Heights Park and Community Garden

Holy Spirit Lutheran Church - Auxiliary Room

Home Helpers

Home2 Suites

Homewood Suites by Hilton, Historic District/Riverfront

Homewood Suites by Hilton, White Bluff Rd

Hop Atomica

Hope City

Hoppers Paintball & Airsoft

Hospice Savannah

Hospice Savannah's Full Circle Grief and Loss Center

Hostess City Hot Glass

Hostess City Toastmasters C;ub Facebook Live

Hotel Indig

Hotel Indigo

Hotel Tybee

HOTWORX (Sandfly)

House of DANIETTÉ

How 2 Run

Howard Family Dental

Howard Jordan Building - SSU

Howard Jordan Building - Torian Auditorium

Howe2Run

Howe2Run Specialty Store

https://gi.org/concert/

https://us02web.zoom.us/j/81639111671

Huc-A-Poo’s

Hudson Hill Center

Hudson Hill Community Center

Hull Park

Humane Society of Greater Savannah

Hunter Army Air Field

Hunter Club at Hunter Army Airfield

Hunter Golf Course

Husk

Hustle & Blow Dry Bar

Hutchinson Island

Hyatt Regency Hotel

Hyatt Regency Savannah

Hyperformance Athletics

I Owe Jesus Praise Experience

I Sparkle Party Palace

Iglesia Pentecostal Evangelistas

Immanuel Baptist Church

Indian Motorcycle, Savannah

Indulge Coffee

Inner City Night Shelter

International Diamond Center

International Diamond Center IDC

iResearch Savannah

Island Sports Bar

Islands Ace Hardware

Islands Cottage Art-Studio and Gallery

Islands Family YMCA

Islands Farmers & Community Holiday Market

Islands Farmers Market

Islands High School

Islands Library

Islands Sports Bar

Isle of Hope Baptist Church

Isle of Hope Marina

Isle of Hope Pool

Isle of Hope United Methodist Church

Israelite Baptist Church

Isreally Hummus

It's Amazing Hair & Beauty Center

Its Cooler in Pooler - The Trisha Cook Team

IV Parlour Medspa

J.C. Lewis Primary Health Care Center

Jackson Woods Blvd. and Habersham St.

Jacob Grant Community & Teen Center

Jaguar Land Rover Dealership

Jalapenos Mexican Grill, Richmond Hill

Jamie Casino Injury Attorneys

Java Burrito

Jaycee Park

Jaycees Hut

Jazz'd Tapas Bar and Restaurant

JEA

Jekyll Island

Jekyll Island, GA

Jenkins Athletic Club

Jenkins Hall

Jenkins High School

Jennifer Ross Soccer Complex

Jepson Center

Jepson Center for the Arts

Jepson Center for the Arts, Neises Auditorium

Jeremiah's Italian Ice of South Savannah

Jewish Educational Alliance

Jewish Educational Alliance (JEA)

JF Gregory Park

Jim 'N Nick's Community BBQ

Job Fair

Joe Marchese Construction

Joe Murray Rivers, Jr. Intermodal Transit Center

Joe's Crab Shack Savannah

John Davis Florist

John Paul II Catholic School

John S Delaware Center

Johnnie Ganem's Wine & Package

Johnny Mercer Theater at the Savannah Civic Center

Johnny Mercer Theatre

Johnny Mercer Theatre at the Savannah Civic Center

Johnson Square

Joseph Tribble Park

Jug Knight Field at Scarborough Sports Complex

Juliette Gordon Low Birthplace

Juliette Gordon Low Birthplace Museum

Juliette Gordon Low Park

Juliette Low Park

Junior Achievement Colonial Group Discovery Center

Junior Achievement Discovery Center

Junior League of Savannah HQ

JUST LOVE COFFEE

JW Marriott Savannah Plant Riverside District

Kavanaugh Park

Kayak Kafé, Midtown

KB's Cafe

Kehoe Iron Works

Kehoe Iron Works at Trustees' Garden

Kehoe Ironworks at Trustees' Garden

Kehoe Ironworks Building

Keller’s Flea Market

Kendra Scott

Kendra Scott, Broughton St

Kennedy Fine Arts Building, Savannah State University

Kensington Park

Kessler Plant Riverside District Construction Office

Kimpton Brice Hotel

King Oliver's Creole Jazz Bar

Kingdom Life

Kingdom Life Christian Fellowship

Kingdom Life Christian Fellowship Church

Kingdom Life Ministries

Kings Ferry Park Savannah Ga

Kirschner Furs

Knack Studio

Knights of Columbus #5588

Knights of Columbus Council 631

Kobo Gallery

Kombative Academy of Traditional Martial Art (KATMA)

L. Scott Stell Park

La Aparicion Speakeasy Lounge

La Scala Ristorante

Labels on Liberty

Lafayette Square

Lake Church Cemetery

Lake Mayer

Lake Mayer Community Center

Lake Mayer Park

Lalka Beauty Co.

Landings Athletic Field

Landings Club - Plantation ballroom

Landmark Historic District of Savannah

Laney Contemporary

Laney Contemporary Fine Art

Latin Chicks

Latin Chicks Restaurant

Lattimore Park

Laurel Grove Cemetery North

Le Chat Noir

Legacy @ Savannah Quarters

Leopold's Ice Cream, Downtown Savannah

Lewis Cancer & Research Pavilion

Liberty City Center

Liberty City Church of Christ

Liberty City Community Center

Liberty Community Center

Liberty YMCA

Life Church

LIfe Moves Dance Studio

LIFE Office

Lightfoot Company

Lighthouse Baptist Church

Lili's Restaurant and Bar

Lincoln & South Brewing Company

Lincoln and South Brewing Company

Linen & Line Designs

Liquid Cafe

Lite Foot Company

Little Bryan Missionary Baptist Church

Littles on Liberty

Litway Missionary Baptist Church

Live at The Blue Door

Live Oak Public Libraries

Live Oak Public Libraries, Bull St Branch

Live Oak Public Libraries, Islands Branch

Live Oak Public Libraries, Southwest Chatham Branch

Live Oaks Park

Living Independence for Everyon (LIFE), Inc.

Locally Made Savannah

Locally Made Savannah Artisan Market

Location Gallery at Austin Hill Realty

Lodge of Sorrows

Loews Philadelphia Hotel

Lone Wolf Lounge

Lost Plantation Golf Club

Lost Square

Lot 9 Brewing Company

Lotts Island Hunter Army Airfield

Love's Seafood

Low Country Dermatology

Lowcountry Celebration Park

Lowcountry Made / Juice Hive

Lower Woodville-Tompkins

LTOP Angels of Mercy Food Ministry

Lucas Theatre

Lucas Theatre for the Arts

Lucky Savannah Offices

Lucky's Market

Lufburrow Realty

Luggage Drop

Luna Healing Arts

Luthera

Lutheran Church of Ascension

Lutheran Church of the Ascension

Lutheran Church of the Ascension's

Lutheran Church of the Redeemer

LUX ~ A Medical Spa

LUX ~ A Medical Spa Hilton Head

LVL Up – Pizza & Barcade

Madison Square

Manpower Savannah

Mansion La Belle

Mansion on Forsyth

Mansion on Forsyth Park

Mapa

Marine Education Center and Aquarium

MarineMax

Marquee Manor

Marriott Savannah Riverfront

Marshpoint Elementary School

Martin Family Park

Martin Luther King Jr Arena

Mary Kahrs Warnell Forest Education Center

Mary Ross Park

Massage Masters

Massie Heritage Center

Mata Hari's Speakeasy

Maven Makers

Maycrest Hardware

Mayer Community Park Pavilion

McCauley Park

McDonough's Restaurant & Lounge

McDonoughs

Megan Myrick Photography Studio

Mellow Mushroom Pooler

Mellow Mushroom Savannah

Memorial Health Hospital campus

Memorial Health University Medical Center

Memorial Stadium

Merchants on Bee

Meridth Lamas State Farm

Merita Parker

Mermaid Point Tybee

Merritt Condominiums Clubhouse

Messiah Lutheran Church

Mexicali Fresh Restaurant Savannah

Mia Madison Properties

Midtown Sports Grill

Mill Creek Park - Playground Pavilion

Mint to be Mojito

Mint To Be Mojito Bar & Bites

Mint To Be Mojito Bar and Bites

Mint To Be Mojito Bar at Speakeasy

Mint to Be Mojitos

Mission: Possible Transitional Living Program

Mobility City of Savannah

Moe's Southwest Grill

Mohawk Park

Molly MacPherson's Scottish Pub & Grill

Monterey Square

Montgomery Athletic Association

Montmollin Building

Moodright's

Moon River Brew Company

Moon River Brewing Company

Morning Glory Temple of Deliverance

Morris Center

Mosaic Church

Moses Jackson Center

Moss + Oak Eatery

Motel 6

Mother Matilda Beasley Park

Mount Bethel Baptist Church

Ms Polly’s Cake Giants, Broughton St

Mt Sinai Missionary Baptist Church

Multiple Locations

Murray C. Perlman & Wayne C. Spear Preservation Center

Myrtle & Rose Rooftop Garden

Mystic Apothecary

Namaste Savannah

Nantucket's Meat & Fish Market

Narra Tree

National Guard Armory

National Museum of the Might Eighth Air Force

National Museum of the Mighty Eighth Air Force

National Spay Alliance Foundation

National Spay Alliance Savannah

National Youth Advocate Program

NCG Cinema

NCG Theater

Near UGA Ocean Science Center

Neighborhood Comics

New Beginnings Community Church

New Generation

New Realm Brewery, 3rd floor

New Realm Brewing

New Realm Distillery

New Saint Luke A.M.E. Church

New Yoga Now

New York Marriott at the Brooklyn Bridge Hotel

Next to River Drive Crossfit

NFI Bloomingdale

Nine Line Apparel

Nine Line Apparel on River Street

No Limit: Disability Swim Days

North Beach Bar & Grill

North Beach on Tybee Island

North Beach, Tybee Island

Nourish Natural Bath - Midtown Savannah

Nourish Natural Bath - Pooler

Nourish Natural Bath Products

Novel Coworking

Oak 36 Bar Kitchen

Oak Terrace at Rose Hill

Oaks at Habersham

Oasis of Hope

Oatland Island Wildlife Center

Octane Bar & Lounge

Ogeechee Farmers Market

Ogeechee Meat Market

Oglethorpe Chocolates

Oglethorpe Mall

Oglethorpe Mall Library

Oglethorpe Speedway

Ohana Spine & Ortho Care - Pooler

Old Fort Jackson

Old Roberds Dairy Farm

Old Savannah City Mission

Old Savannah Tours

Old Town Bluffton

Old Town Dispensary

Old Town Trolley Tours of Savannah Office

Oldfield Golf Club

Oliver Maner

Oliver Maner, LLP

Olmsted Savannah

Ology Gallery

On-Line Pay-per-Vote

One Community Fundraiser T-shirts

One Hundred Miles (OHM), Savannah Office

Online

Online with ZOOM

Online/Virtual

Ordinary Magic

Ordinary Magic Savannah

Ordinary Magic Savannah Yoga

Origin Coffee Bar

Orleans Square

Osaka

Osaka, Japan

Ossabaw Island

Otis J Brock III Elementary

Ottawa Farms

Outside Savannah Retail Location

Over Yonder

Overcoming by Faith

Overcoming by Faith Ministries

Owens-Thomas House & Slave Quarters

P23 Labs

Pacci Italian Kitchen & Bar

Painting with a twist

Painting with a Twist, Pooler

Painting with a Twist, Savannah

Palmetto Club at The Landings

Panera Bread, 8108 Abercorn St

Paradise Bay Express Car Wash

Park Hyatt Washington D.C. Hotel

Park Place Outreach

Parker’s House

Parkside Christian Church

Parkside Pop-Up

Paula Deen Headquarters

Paula Deen's Creek House Seafood & Grill

Paulsen Square

Paulson Softball Complex

PawParazzi Pet Boutique

Paxton Park

Peacock Chrysler Jeep Dodge Ram Fiat

Peacock Subaru

Peacock Subaru Hilton Head

Peacock Used Cars & Trucks

Pegasus at The Historic Roberds Dairy

Pegasus Riding Academy

Pegasus Riding Academy at Historic Roberts Dairy

Pendant Terrace & Bar

Pennsylvania Avenue Resource Center

Pennsylvania Avenue Resource Center (PARC)

Pepe Hall SCAD

PERC Coffee Roasters

Perch, above Local 11ten

Peregrin

Perfection Salon

Performance Initiatives

Perry Lane Hotel

Perry Lane Hotel Ballroom

Pet Supermarket

PetSmart, Abercorn St

PetSmart, E Victory Dr

Philadelphia Marriott Downtown Hotel

Picadilly Square Shopping Complex

Pie Society

Pin Point Heritage Museum

Pin Point Seafood Festival

Pinnacle Plastic Surgery

Pirates' House

Pitchers Sports Bar & Grill

Pizza Party

Planet Fitness

Planet Fitness, Rincon

Planet Fun

Plant Riverside Amphitheater

Plant Riverside District

Plant Riverside District - Amethyst Room

Plant Riverside District - Atlantic Building

Plant Riverside District - Beethoven's Terrace

Plant Riverside District - Generator Hall

Plant Riverside District - Grand Bohemian Gallery

Plant Riverside District - Lobby

Plant Riverside District - Martin Luther King, Jr. Park

Plant Riverside District - Martin Luther King, Jr. Park Stage & Pavilion Stage

Plant Riverside District - Pavilion Stage

Plant Riverside District - River Landing, Atlantic Building

Plant Riverside District - Salzburg Ballroom

Plant Riverside District - Turbine Café in Generator Hall

Plantation Lumber

Planted in Savannah

Play on Zoom - Watch on Facebook Live!

Poe’s Tavern

Poetter Hall

Police Memorial Trail Trailhead at Kerry St and Dixie Ave

Polks Plus

Pooler City Hall

Pooler Day Spa

Pooler Karate and Krav Maga

Pooler Memorial Park

Pooler PetSmart

Pooler Recreation Behind YMCA On Pooler Parkway, Field 12

Pooler Recreational Complex

Pooler Sam's Club

Pooler, GA

Port canaveral

Port City Logistics

Port City Logistics - Port Wentworth

Port Royal Golf Club, Barony Course

Port Wentworth City Hall

Portman's Music Superstore

Pour Larry's

Precision Wellness

Premier Bowl & Bistro

Priest Landing

Primera Iglesia Bautista

Profile by Sanford

Profile by Sanford Savannah

PROGRESSIVE RECREATION CENTER

Providence Presbyterian Church

Provisions

Pure Barre, Savannah

Pure Sweat Sauna Studios

Quality Inn - Midtown

Radiant

Rahn Hall, Unitarian Universalist Church (entrance on East Macon Street)

Ralph Mark Gilbert Civil Rights Museum

Rancho Alegre Cuban Restaurant

Randy Wood's Old Time Pickin' Parlor

Randy's Pickin' Parlor

Ranicki Chiropractic

Rat on Bull

Raw IImage Barbershop and Studio

Ray Ellis Gallery

Realty One Group Inclusion

Red & White Food Store

Red and White

Red Door Auction Yard

Red Fern Fine Art Studio

Red Gate Entrance

Red Gate Farms

Red Velvet Burlesque Show Savannah

Regus Savannah

Reinhard Farmhouse

Relentless Church

Remedy SOS

Renegade Insurance

Renegade Office

Renegade Paws Rescue

RenewalMD

RePurpose Savannah

Residence Inn by Marriott Savannah Airport

Restoration Chiropractic

Reynolds Square

Rhett

Rhett Restaurant at The Alida Hotel

Ricciardi's Pizzaria

Richmond Hill Bryan County Chamber of Commerce

Richmond Hill City Center

Richmond Hill Fire Department

Richmond Hill Funeral Home

Richmond Hill Golf Club

Richmond Hill Goodwill

Richmond Hill History Museum

Richmond Hill Wetlands Center

Ridgewood Park

Rita's Italian Ice & Frozen Custard

Rita's Italian Ice & Frozen Custard - Pooler

River Drive Cross Fit

River Drive CrossFit

River Drive, Thunderbolt

River Street

River Street Sweets

River Street Sweets - Broughton

River Walk of Savannah

River's Edge Community Dock

Rivers Bend Marina

Riverton Pointe Golf & Country Club

Riverview Health & Rehabilitation Center

Riverworks Eastern Wharf

Rocks on the River

Rocks on the Roof at The Bohemian Hotel Savannah Riverfront

Rogue Water

Roll the Bones Game Store

Ronald McDonald House Charities of the Coastal Empire

Roots Up Gallery

Rose Hill Equestrian Center

Ross Medical Education Center

Rotary Community Center

Rousakis Plaza

Rousakis Riverfront Plaza

Royal Cinemas

Royal Treatment Barber Parlor

Ruskin Hall

Russo's Fresh Seafood Bluffton

Sacred Heart Church

Saddle Bags Savannah

Saddlebags Savannah

Safe Harbor Bahia Bleu

Safe Harbor Bahia Bleu Marina

Safe Harbor Bahia Blue

Safe Harbor Marina - Bahia Bleu

Saint Bibiana

Saint Leo University

Saint Leo University- Savannah Center

Saints and Shamrocks

Salacia Salts

Salon de Baile Dance Studio

Salt Island

Salt Island Fish & Beer

Salvation Army

Salvation Army - Brunswick AND (video) Merrill Lynch Peirce Fenner & Smith

Salvation Army Baseball Field

Salvation Army Community Center

Salvation Army Corps Community Center

Salvation Army Corps Community Center (Baseball Field)

Salvation Army Savannah

Salvation Army, 3000 Bee Road, Savannah

Sanctuary of Praise Christian Assembly

Sanfrancisco, USA

Sanitation Headquarters Facility

Savannah

Savannah , GA 31406

Savannah #3 Fire Department

Savannah 11 AMC Theater

Savannah Adventist Christian School

Savannah African Art Museum

Savannah Area Chamber of Commerce

Savannah Area REALTORS®

Savannah Art Association Gallery

Savannah Arts Academy

Savannah Ballet Theatre

Savannah Bee Company

Savannah Bee Company Showroom

Savannah Bee Company, Wilmington Island

Savannah Boathouse

Savannah Botanical Gardens

Savannah Bottle Works

Savannah Cabaret

Savannah Chatham CASA

Savannah Children's Museum

Savannah Children's Theatre

Savannah Christian Preparatory School

Savannah Christmas Tree

Savannah City Hall

Savannah City Market

Savannah Civic Center

Savannah Civic Center, Ghost Pirates Ice

Savannah Classic Cars

Savannah Classical Academy

Savannah Clemente Course

Savannah Coffee Roasters

Savannah Coffee Roasters, Liberty St

Savannah Comedy Revue

savannah comedy revue 1

Savannah Comedy Revue 12

Savannah Convention Center

Savannah Convention Center 1 International Drive Savannah, GA 31402

Savannah Country Club

Savannah Country Day School

Savannah Culinary Institute at 7 West Bay Street

Savannah Cultural Arts Center

Savannah Dance Co. - Springfield

Savannah Dental

Savannah Elks Lodge #183

Savannah Entrepreneurial Center

Savannah Entrepreneurial Center - Online

Savannah Fire Station #5

Savannah Garden Tours - Isle of Hope

Savannah Golf Club

SAVANNAH HARBOR GOLF CLUB

Savannah Harbor Golf Course

Savannah Harley Davidson

Savannah Historic District

Savannah History Museum

Savannah Holistic Co-op

Savannah Holistic Group

Savannah Holly Days Tree

Savannah Hydroponics & Organics

Savannah International Trade and Convention Center

Savannah Jaycees

Savannah Jaycees Hut

Savannah Machinery Works

Savannah Mall

Savannah Marina

Savannah Marriott Riverfront

Savannah Music Festival

Savannah National Wildlife Refuge

Savannah Octane Bar

Savannah Ogeechee Canal Museum and Nature Center

Savannah Old Town Trolley

Savannah On Wheels

Savannah On Wheels - New Location!

Savannah Perfume and Candle Co

Savannah Police Department

Savannah Power Yoga

Savannah Quarters

Savannah Quarters Country Club

Savannah Quarters, Westbrook Grove

Savannah Repertory Theatre

Savannah Repertory Theatre PLAYshop

Savannah Riverboat Cruises

Savannah Riverfront Marriott

Savannah SCORE

Savannah Smithereens

Savannah Soundings WRUU

Savannah Speech & Hearing Center

Savannah Square Pops

Savannah State University

Savannah State University Graduate School Building Downtown

Savannah State University Student Union

Savannah State University, Social Sciences Building

Savannah Station

Savannah Station event hall

Savannah Streetcar Design District

Savannah Taphouse

Savannah Taste Experience

Savannah Taste Experience Marketplace

Savannah Tech Crossroads Campus

Savannah Technical College

Savannah Technical College, Crossroads Campus

Savannah Technical College, Eckburg Auditorium

Savannah Technical College, Savannah Campus

Savannah Technical College’s Eckberg Auditorium

Savannah Tequila Co. at Plant Riverside District

Savannah Theatre

Savannah Trade and Convention Center

Savannah Tree Foundation Office

Savannah Victory Gardens

Savannah Waterfront

Savannah Wine Cellar

Savannah Wine Institute

Savannah Yacht Club

Savannah Yoga Center

Savannah's Waterfront

Savannah's Clay Spot

Savion Gallery

Savoy Society

SBAC (Small Business Assistance Corporation)

SCAD Museum of Art

SCAD Pei Ling Chan Gallery

SCAD Savannah

SCAD Student Center

SCAD's Pei Ling Chan Gallery, Afifi Amphitheater, and Garden for the Arts

SCADstory

Scarborough Sports Complex

Scribble Art Studio

Seaport Real Estate

Seaquins Ballroom

Seaside Sisters

Second African Baptist Church

Second Arnold Missionary Baptist Church

Second Ebenezer Missionary Baptist Church

Second Harvest of Coastal Georgia

Second Street Garden

Secret location in Savannah Georgia

Secret Outdoor Location in Savannah, GA.

Select Saved Locations

Senior Citizens, Inc.

Sentient Bean

Sentient Bean Listening Room

Serenity Med Spa

Service Brewing

Service Brewing Co

Service Brewing Company

SGTV Studios

Sharon Park

Sharon Park in Garden City

Sheltair Aviation SAV

Shepherd Living at Savannah Quarters

Ships of the Sea Maritime Museum

Ships of the Sea Museum

Ships of the Sea Museum and Gardens

Sho-Nuff Deli

Shot by Somi Studios

Shuk

Simplicity Creations

Skeeter's Southern BBQ

Skidaway Community Church

Skidaway Community Church Parking Lot

Skidaway Institue of Oceanography

Skidaway Institute of Oceanography

Skidaway Island Baptist Church

Skidaway Island Presbyterian Church

Skidaway Island State Park

Skidaway Island United Methodist Church

Skinny Salad

Skylark Apartments

Sleep Inn Mainstay Savannah Midtown

Small Business Assistance Center

Small Business Assistance Corporation

Small Business Development Center

SMG Advertising + Film

Smithereens

SOBA Art School

Sobremesa

Sobremesa Wine Bar

Society of Bluffton Artists (SoBA)

Softball Field

Soho South

Soho South Cafe

Sonja Robinson Gallery of Art

Sorrel Weed House

Sorrel Weed House Museum

Sorry Charlies

Soul Waves Healing Arts Community Studio

Soul Waves Studio

South Effingham High School - Mustang Corral Football Field

south georgia fairgrounds

South Georgia State Fairgrounds

South University

Southbound Brewing Company

Southbridge Golf Club

SouthCoast Health Pediatric in Richmond Hill

SouthCoast Health Savannah Campus

Southern Barrel Brewing Co

Southern Motors Honda

Southern Sugaring

Southside Assembly of God

Southside Baptist

Southside Baptist Church

Southside Baptist Church - Community Outreach Center

Southwest Chatham Library

Southwest Middle School

Space Coast Coffee

Spanky's Southside Pizza Galley & Saloon

Spanky's, Southside

Spark by Hilton Savannah Airport

Spectra Food Services - Enmarket Arena Job Fair

Spirit of Peace Lutheran Church

Spread Bagelry

St John’s Church

St Leo University Savannah Education Center

St Mary's Community Center

St Paul’s Hellenic Center

St Peter's Episcopal Church

St Philip African Methodist Episcopal Church

St Philip Monumental AME Church

St. Andrew's School

St. Anne’s Catholic Church

St. Francis of the Islands Episcopal Church

St. James AME Church - Wilson Bostic Complex

St. John Baptist Church

St. John's Episcopal Church

St. Johns Episcopal Church Green-Meldrim House

St. Joseph Candler AAHIRC Center

St. Mary Magdalene Orthodox Church

St. Matthew's Episcopal Church

St. Michael Catholic Church

St. Neo's Brasserie

St. Paul's Episcopal Church

St. Peter Episcopal Church

St. Peter's Episcopal Church, Skidaway Island

St. Thomas Episcopal Church on Isle of Hope

St. Vincent's Academy

Stafford's Public House

Star Castle

Starbucks - West Bay St

Starland District

Starland Strange

Starland Strange & Baazar

Starland Strange and Bazaar

Starland Yard

Starlandia Supply

State Capitol

State Visitor Information Center

Statesboro Downtown Dog Park

Staybridge Suites Savannah Airport

STEM Academy at Bartlett Middle School

Step One Auto

Step One Automotive

Stevedore Bakery

STF Office

Sting Ray's

Stir Coffee Co.

Stone & Webster Chophouse in Plant Riverside District

Stone stairs of Death

StoneLords

Strange Bird

STUMP

Stump Savannah

Sulfur Studios

Summit Funding

Summit Gymnastics

Sun City Hilton Head

Sunset Bay

SunTrust Bank, Johnson Sq

Superbloom

Sweet Patricia's

Sweet Water Spa

Syd Nichole

T.S. Chu's

Tacos + Tequila

Tailgate Sports Bar & Grill

Talahi Island Community Center

TalkOne Radio

Tanger Outlets

Tanger Outlets 1 in Bluffton SC

Tanger Outlets, Pooler

Tapley's Mercantile and Antiques

Tapley’s Mercantile & Antiques

Tatemville Neighborhood Center

Taylor Park - Bloomingdale

Taylor Square

TBD

TBD - More details to come!

Team Callahan at Keller Williams Realty

Telfair Academy

Telfair Museums Jepson Center

Telfair Square

Temple of Glory Commuity Church Main Auditorium

Temple of Glory Community Church

Temple of Glory Community Church Administration Building

Temple Treatment Loft

Tequila's Town Mexican Restaurant, Sandfly

Teresa Cowart Team

Texas Roadhouse, Pooler

The 5 Spot

The 5 Spot - Sandfly

The 5 Spot Neighborhood Kitchen and Bar

The 5 Spot on Broughton

The Alee Shrine Temple

The Alida Hotel

The Andaz Hotel

The Armstrong Center

The Bamboo Room Tiki Bar

The Bank

The Barn

The Barn at Red Gate Farms

The Baxly

The Beach Institute

The Beach Institute African-American Cultural Center

The Bling Venue

The Blood Connection

The Blood Connection - Savannah

The Bluff Hotel

The Bluff Hotel Historic District

The Bohemian Hotel Savannah Riverfront - Rocks on the River

The Bonefish Grill

The Bright House Visitation Center

The Broughton Hotel

The Bull Street Light Room

The Burn at Bethesda

The Bus Depot

The Cathedral Basilica of St. John the Baptist

The Cathedral of St. John the Baptist

The Children's School at St. John's Church

The Circle

The Club at Savannah Harbor

The Clyde

The Clyde Market and Venue

The Clyde Venue

The Coastal Georgia Botanical Gardens at the Historic Bamboo Farm

The Collective Savannah

The Collegiate Church of St Paul the Apostle (Episcopal)

The Collegiate Church of St. Paul the Apostle

The Collegiate Church of St. Paul, Apostle

The Crab Shack

The Creative Coast

The Crypt Pub

The Culturist Union

The Culturist Union Artisan Marketplace and Coffeehouse

The DeSoto

The DeSoto Savannah

The Distillery

The Drayton Hotel

The Family Justice Center

The Fancy Pheasant

The Farm

The Firm Savannah

The Fitzroy

The Ford Field and River Club

The Front Porch

The Front Porch - Pooler

The Front Porch - Savannah

The Garage at Victory North

The Gardens of Savannah

The Gingerbread House

The Good Feet Store

The Green-Meldrim House

The Grey Restaurant

The Grove

The Grove (Starting Location)

The Grove Savannah

The Grove Savannah Jefferson Street Sidebar

The Haven at Islands Counseling

The Heavenly Spa by Westin Savannah

The Hipster Hound

The Historic Apothecary House

The Historic First Bryan Baptist Church

The Historic Second African Baptist Church

The Horne Law Firm

The Hub

The HUB Savannah

The International Seamen's House

The JA Colonial Group Discovery Center

The JA Colonial Group Discovery Center, 11935 Abercorn Street, Georgia Southern Armstrong Campus, Savannah, GA, 31419, US

The Kimpton Brice

The Kimpton Brice Hotel

The Lady and Sons

The Landing's Club

The Landings Club, Palmetto Clubhouse

The Landings Golf

The Landings Golf and Athletic Club

The Landings Palmetto Club

The Landings: Marshwood & Magnolia Golf Courses

The Learning Center at Senior Citizens, Inc.

The Legacy at Savannah Quarters

The Light

The Local on Laurel

The Location Galllery

The Lodge of Sorrows

The Lost Square

The Lost Square at The Alida Hotel

The Mansion on Forsyth Park - Grand Bohemian Gallery

The Market Place at the History Museum

The Mediation Center of the Coastal Empire

The Melting Pot

The Mighty Eighth Musuem

The National Museum of the Mighty Eighth

The Nest Gallery

The Nest Rooftop Lounge

The Nixon Centre for the Arts

The Old Dairy Farm

The Olde Pink House

The Opportunity Center at Goodwill

The Ordinary Pub

The Outfitters at Heartwood

The Palmetto Club at TheLlandings

The Paris Market & Brocante

The Park at Eastern Wharf

The Peacock Lounge

The Pickin' Parlor

The Pirates House

The Printmakers Inn

The Rail Pub

The Rep - Downtown

The Ritz-Carlton Philadelphia Hotel

The River Golf Club

The Rooftop at The Drayton Hotel

The Room at Common

The Sanctuary

The Sanctuary Church

The Savannah Civic Center

The Savannah Comedy Review @ Bay Street Theater

The Savannah Country Club

The Savannah Country Day School

The Savannah Underground

The School at Higher Ground (housed at Higher Ground Baptist)

The Seed Church

The Sentient Bean

The Shop on MLK

The Shoppes at 1207

The Showroom

The Signature Gallery

The Skin Studio

The Smile and Face Company

The SOBA Art School

The Social at Savannah

The Stables

The Studio Medical Spa

The Studio Savannah

The Sunset Landing

The Taco Stache

The Tiny Beet Lifestyle Medicine Pediatrics

The Toasted Yolk Cafe- Savannah

The Venetian Resort Las Vegas

The Venue

THE VENUE Banquet Hall & Conference Center

The Village Library

The Vinyl Room

The Warehouse Bar & Grille

The West Broad

The Westin

The Westin Book Cadillac Detroit Hotel

The Westin Charlotte Hotel

The Westin Copley Place Boston Hotel

The Westin Savannah Harbor

The Westin Savannah Harbor Golf Resort & Spa

The Westin Seattle Hotel

The Whitfield Center

The Wormhole

The Wyld

They Collins Quarter at Forsyth Park

Thibault Gallery

Third Space Collective

Thomas & Hutton

Thomas Square Park

Thompson Hotel

Thompson Savannah

Thomson Park

Three Muses Building

Thrive Early Learning Center

Thrive On Skidaway

Thunderbolt Counseling Services

Thunderbolt Health and Rehab

Thunderbolt Marine

Thunderbolt Museum Society

Tide & Country

Tiedeman Park

Tier One Nutrition

Tijauna Flats

Toasted Barrel Savannah

Toekomsrus ( Randfointein )

Tom Triplett Park

Tom Tripplet Park

Tominac Fitness Center

Tommy Long Boat Ramp

Tommy Long Landing

Tompkins Community Center

Tompkins Pool

Tompkins Regional Center

Tondee's Tavern

Top Dawg Tavern - Hilton Head Island

Top Deck Bar

Top Shelf Ammo

Tormenta Stadium

Tosa Coffee Company

Total Fabrications

Totally Awesome Bar

Tout Sweet Macrons

townsley chapel ame church

TPC Sawgrass

TPG Isle of Hope Marina

Tractor Supply - Ogeechee Road

Treylor Park Pizza Party

Tricentennial Park

Trinity Lutheran Church

Trinity United Methodist Church

Triple J Stables & Petting Zoo

Triple J Stables and Petting Zoo

Tropical Smoothie Cafe

Troupial

Trustees' Garden

Trustees' Theater

Tubby's Tank House

Tubby’s Tankhouse in Thunderbolt

Tubby's Tank House, Thunderbolt

Two Tides Brewing

Two Tides Brewing Co.

Two Women and A Warehouse

Tybee Arts Association

Tybee Arts Black Box Theatre

Tybee Island

Tybee Island American Legion - Post 154

Tybee Island Beach Pier and Pavilion

Tybee Island Farmer's Market

Tybee Island Lighthouse & Museum

Tybee Island Main Street

Tybee Island Marine Science Center

Tybee Island Pier and Pavilion

Tybee Island Pirate Fest

Tybee Island Wedding Chapel

Tybee Island YMCA